Starting and scaling a business in Ohio comes with more than just vision and grit — it comes with legal responsibility. Whether you’re forming your first LLC or leading a mid-sized company through its next stage of growth, having the right documents in place at the right time makes all the difference.

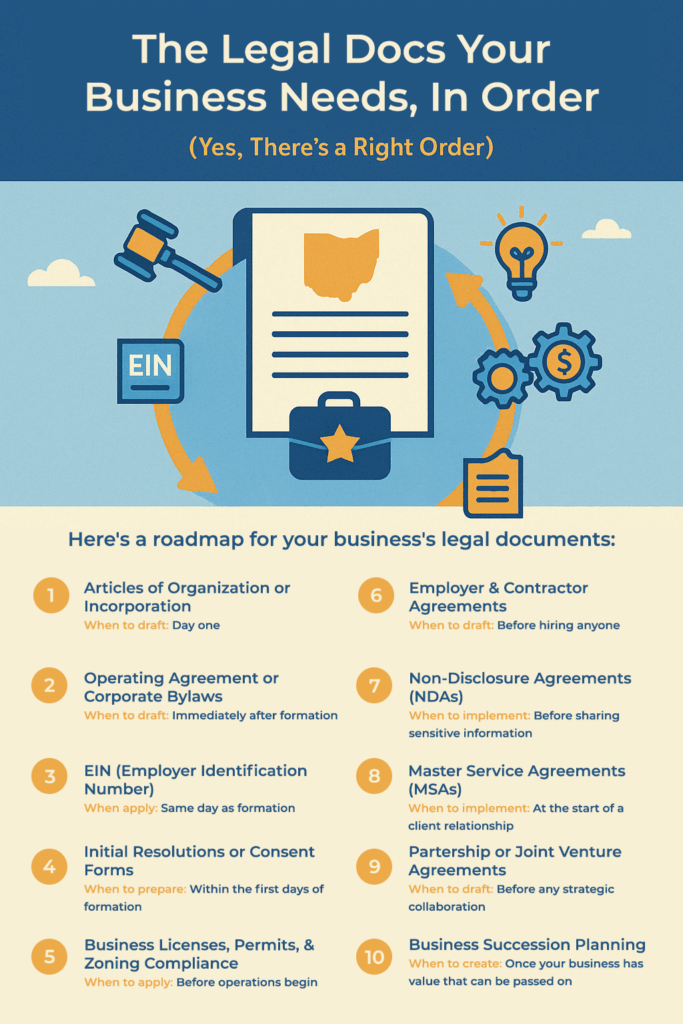

Here’s a chronological roadmap of the legal documents your Ohio business should have in place, from formation through succession planning.

1. Articles of Organization (LLC) or Articles of Incorporation (Corporation)

When to file: Day one, before you start doing business

This is your business’s legal birth certificate. Filed with the Ohio Secretary of State, these documents establish your business as a separate legal entity. You’ll include your business name, registered agent, and purpose, and you’ll choose whether to be member- or manager-managed (for LLCs).

2. EIN (Employer Identification Number)

When to apply: Immediately after formation

Your EIN is your business’s federal tax ID — the business equivalent of a social security number. An EIN/TIN is needed to open a business bank account, hire employees, or elect S-Corp status for taxation. Even if you’re a single-member LLC, you’ll need one to keep your business legally and financially separate from your personal identity.

3. Operating Agreement (LLCs) or Corporate Bylaws (Corporations)

When to draft: Immediately after formation

These are your business’s internal rules. Operating Agreements (for LLCs) and Corporate Bylaws (for corporations) define ownership structure, voting rights, management responsibilities, and profit distribution procedures, among other things. In multi-owner businesses, they’re essential for avoiding future disputes — and for proving legitimacy to banks, courts, and investors.

4. Initial Resolutions and Organizational Minutes

When to use: Within the first days of formation

Your company’s initial resolutions formally authorize your business to take key actions like opening bank accounts, issuing shares (for corporations), or appointing managers and officers. While not required by the state for LLCs, they demonstrate corporate formality — an important standard for keeping your limited liability protection intact.

5. Business Licenses, Permits, and Zoning Compliance

When to apply: Before offering products/services to the public

Whether you’re selling food, offering professional services, or opening a storefront, you may need state or municipal licenses. Ohio requirements vary by industry and locality. Getting this right avoids fines and interruptions to your operations. Visit the Secretary of State website to search for licenses applicable to your business.

6. Trademark and Copyright Applications

When to apply: As soon as you have a product, service, or content available

Trademarks protect your brand identity (name, logo, slogan), while copyrights protect original creative works like articles, music, videos, and software. Registering with the USPTO (for trademarks) or the U.S. Copyright Office (for copyrights) gives you government-recognized legal ownership over your brand and your content, and the ability to enforce those rights against infringement.

Key moments in your business timeline:

- Your logo is finalized and in use

- You’re launching a branded product line or a new service

- You’ve published videos, articles, or design work you want to license or protect

7. Intellectual Property Ownership Agreements & Licensing Agreements

When to use: Any time someone else helps you create content, design, code, or branding

Even if you paid for it, you might not legally own it unless it’s assigned in writing. Use IP assignment agreements when working with contractors, freelancers, or agencies — especially graphic designers, developers, marketers, and writers. Use licensing agreements when allowing others to use your brand, software, or content.

Key moments in your business timeline:

- You hire a graphic designer to create your logo

- You outsource development of your website or app

- You hire a social media marketer or content strategist to create content for your business

8. Employment Agreements and Independent Contractor Agreements

When to draft: Before onboarding any team members

Clearly written agreements outline responsibilities, pay structure, termination rights, and IP ownership. For employees, this provides structure and expectations. For contractors, it defines the scope of work and helps avoid legal risks like misclassification as an employee — which can trigger audits and back taxes.

9. Non-Disclosure Agreements (NDAs)

When to use: Before sharing sensitive business info with outsiders

NDAs protect trade secrets, customer data, marketing plans, and unreleased products and prototypes. Use them with contractors, collaborators, investors, or even potential clients when disclosure of confidential information is necessary.

Pro tip: In Ohio, NDAs must be reasonable in duration and scope to be enforceable. Utilize the Blue Pencil Doctrine to help keep your contracts enforceable.

10. Master Service Agreements (MSAs) + Statements of Work (SOWs)

When to use: When engaging clients or vendors on recurring or complex projects

An MSA lays out the foundational terms of a business relationship — things like payment schedules, liability, dispute resolution, and IP rights. Each project then uses a SOW to define the specific scope, deadlines, and deliverables. This keeps things efficient, reduces negotiation fatigue, and makes your contracts consistent.

11. Partnership Agreements and Joint Venture Agreements

When to use: Before entering into any shared business relationship or revenue-sharing venture

These agreements clearly define each party’s role, equity, obligations, and exit rights. Even if you trust your co-founder or collaborator completely (shoutout to the husband and wife business partners out there), a written agreement will reduce misunderstandings and give you both a clean path forward — or out.

12. Buy-Sell Agreements and Business Succession Documents

When to create: Once your business has value that can be passed on

Buy-sell agreements dictate what happens if an owner dies, retires, or wants to exit. Without one, surviving partners may be stuck with unintended successors — or forced to dissolve the business. These plans often include:

- Ownership transfer mechanisms

- Valuation methods

- Key-person insurance coordination

- Dispute resolution terms

Planning your exit strategy is often the most overlooked step in building a legally sound business. You shouldn’t wait until retirement is around the corner to put succession mechanisms into place.

Why Order and Timing Matter

Each of these documents is like a rung on a ladder: each new step is meant to build upon the last. If you form a business but don’t have a governing agreement, you risk conflict. If you hire without contracts, you risk liability. If you launch a brand without protecting it, you risk losing it before you can grow it.

This order isn’t just logical — it’s legally strategic.

Build Your Business with Legal Confidence

Take a systematic approach to business document creation and application and you won’t need to guess what comes next or backpedal to fix problems later.

For a clear, personalized roadmap for your business documents, book a consultation with us today. We’ll help you:

- Identify gaps in your current document portfolio

- Create a plan based on the stage of your business

- Draft or review contracts tailored to your goals

✅ Schedule your consult now